Trading Places

TP

The Year of 1980

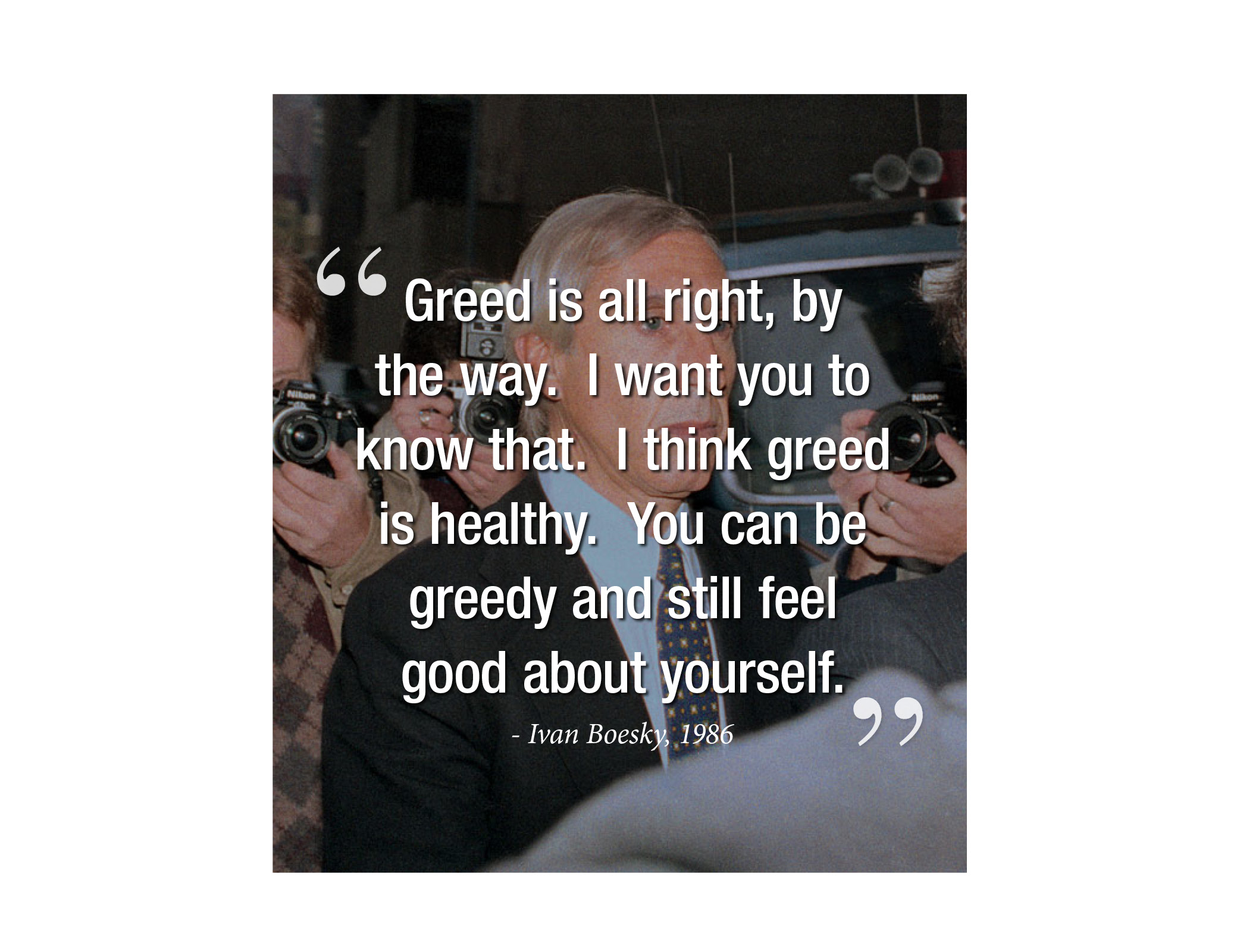

Fast forward several decades, and the market is still dealing with insider trading issues. Ivan Boesky was a Wall Street player who rose to prominence in the 1980s, amassing a fortune in excess of $200 million. He was renowned for betting on corporate takeovers with a practice known as risk arbitrage. Boesky was so successful that he wrote a book, Merger Mania: Arbitrage: Wall Street's Best Kept Money-Making Secret, and gave a famous commencement address at the Haas School of Business Administration at the University of California at Berkley in the spring of 1986. In his speech, he proclaimed "Greed is all right, by the way. I want you to know that. I think greed is healthy. You can be greedy and still feel good about yourself." This speech was adapted for Michael Douglas’s famous “Greed is Good” speech from Oliver Stone’s movie, Wall Street.

Yet Boesky’s success did not stem from quasi-mystical powers that allowed him to predict the future. What he had was material nonpublic information, and he knew the outcome of every corporate merger gamble he took before he placed his bet. It turns out that Boesky was receiving inside information from a key insider at Drexel Burnham Lambert Inc., which was one of the biggest investment banks on Wall Street at the time. His accomplice, Dennis Levine, worked in the mergers and acquisitions department at Drexel Burnham Lambert Inc. and had access to significant amounts of nonpublic information.

Boesky had enticed Levine with an upfront payment of $2.4 million, and Levine dutifully passed along any information he could to Boesky. With this advanced warning, Boesky would purchase as many shares of the targeted companies as he could. Boesky was so brazen that he would often do this only days before the mergers were announced and then sell the shares days later for profits in the millions. But Boesky’s hubris and failure to cover his tracks by purposely betting wrong to diffuse suspicion eventually lead to the SEC taking a keen interest in Boesky’s trades.

The SEC eventually caught up with Levine as the inside source, and he quickly gave up Boesky’s name. Boesky negotiated an arrangement with the SEC and helped them entrap other insider traders, including the high-profile Michael Milken. Boesky was sentenced to three years in prison and fined $100 million. The investigation pulled the rug on a corrupt culture of insider trading on Wall Street during the bull market of the 1980s and lead to the forced bankruptcy of Drexel Burnham Lambert.