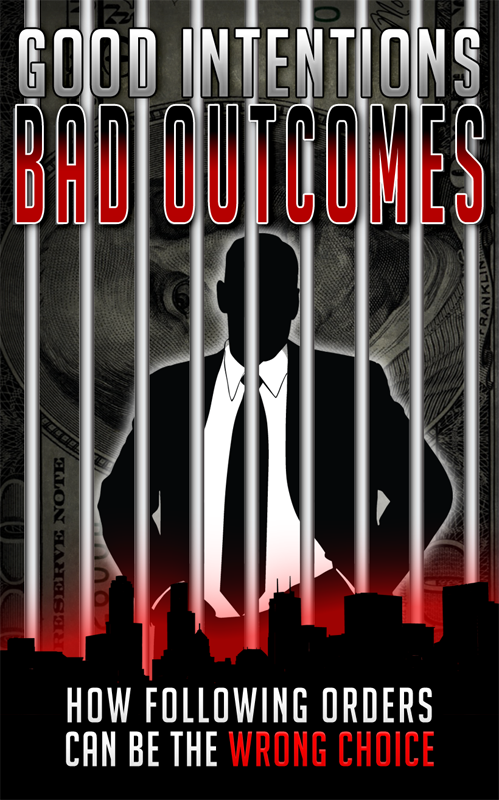

Good Intentions, Bad Outcomes: How Following Orders Can be the Wrong Choice

According to published research on major U.S. Ponzi schemes between 2002 and 2011:

- The most common Ponzi scheme involved fraudulent hedge fund investments.

- Other common schemes included real estate investment frauds, fraudulent promissory notes and fraudulent foreign exchange trading programs, respectively.

- Nearly 40% of Ponzi schemes are conspiracies perpetrated by multiple individuals.

- Nearly 1 in 4 Ponzi schemes involve the use of affinity group targets to build the fraud and increase the scheme’s “credibility.”

Although Harold was following his boss’s orders, he was still implicated in the fraud.

Following the boss’s orders is not a defense that can stand up in a court of law. Betty Vinson, former CPA and Worldcom accountant, found herself in a situation similar to Harold’s. At the direction of Worldcom senior management, Vinson and other WorldCom employees improperly capitalized line costs to overstate pre-tax earnings by approximately $3.8 billion. According to the SEC complaint:

“Vinson knew, or was reckless in not knowing, that these entries were made without supporting documentation, were not in conformity with GAAP, were not disclosed to the investing public, and were designed to allow WorldCom to appear to meet Wall Street analysts' quarterly earnings estimates.”

Betty was sentenced to five months in prison and five months home detention for her role in WorldCom's accounting scandal. She was also sentenced to three years on probation.