Good Intentions, Bad Outcomes: How Following Orders Can be the Wrong Choice

Although Petters and the feeder funds, including Lancelot, made significant promises in order to attract investors, the entire operation was a scam. Harold had no direct contact with Petters, however, he did participate in the fraud by misleading Lancelot investors and other potential investors. The Petters fraud was discovered when Deanna Coleman, a longtime Petters employee, informed law enforcement that she had engaged in a multi-billion dollar Ponzi scheme with Petters for over ten years. She agreed to wear a wire in order to implicate Petters and other co-conspirators in the massive fraud. According to the civil complaint it was revealed that:

- There were no retailers, "big-box" or otherwise.

- No one ordered any merchandise through Petters Co.

- All of the underlying documentation (purchase orders, bills of sale and assignments of security interests) had been fabricated by Petters and others acting at his direction.

- The two vendors Petters claimed he worked with were shell companies with no real operations and the principals were associates of Petters.

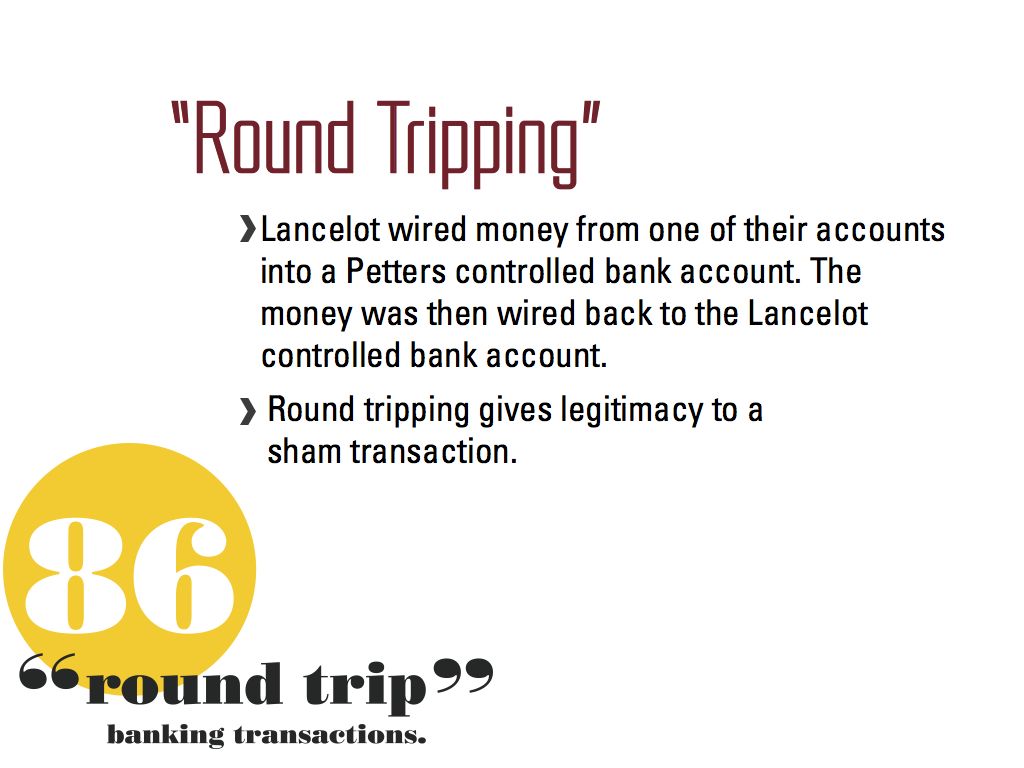

- Each vendor had opened a bank account at the request of Petters. The vendors deposited monies wired to them from investors of Petters Co., took a percentage of that money as compensation for their role in the scheme and returned the rest to Petters.