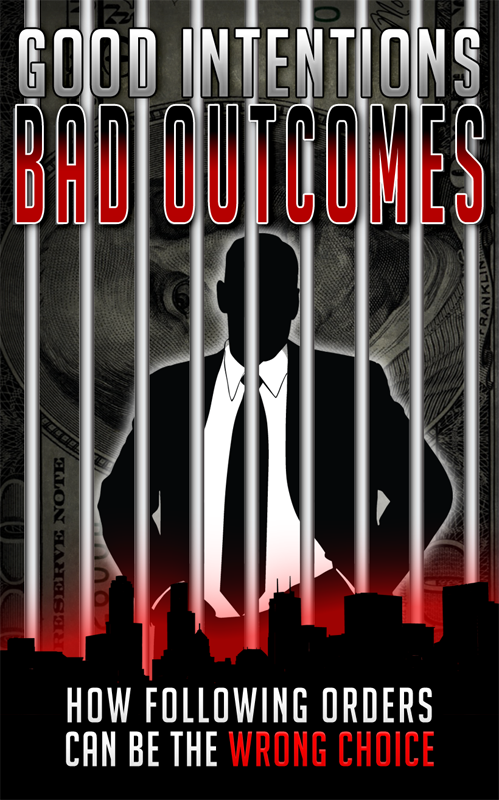

Good Intentions, Bad Outcomes: How Following Orders Can be the Wrong Choice

Tom Petters and Greg Bell met when Bell was managing director of a Florida hedge fund that purchased promissory notes from Petters’s company. During the mid-1990s, Petters began raising funds for his businesses by selling Petters Company Inc. (PCI) promissory notes. Investors included individuals, retirement plans, individual retirement accounts, trusts, corporations, partnerships, and other hedge funds. Petters urged Bell to leave the Florida hedge fund and start his own hedge fund, which led to Bell eventually starting Lancelot Investment Management. Lancelot Investment Management (and Bell) raised $2.62 billion from hundreds of investors through the sale of interest in Lancelot’s three hedge funds. The majority of the funds raised were invested into promissory notes from one firm, Petters Company Inc. Lancelot was actually one of three feeder funds that heavily invested the majority of their funds into Petters Company Inc.

Caption: Dean Lewis describes Tom Petters.