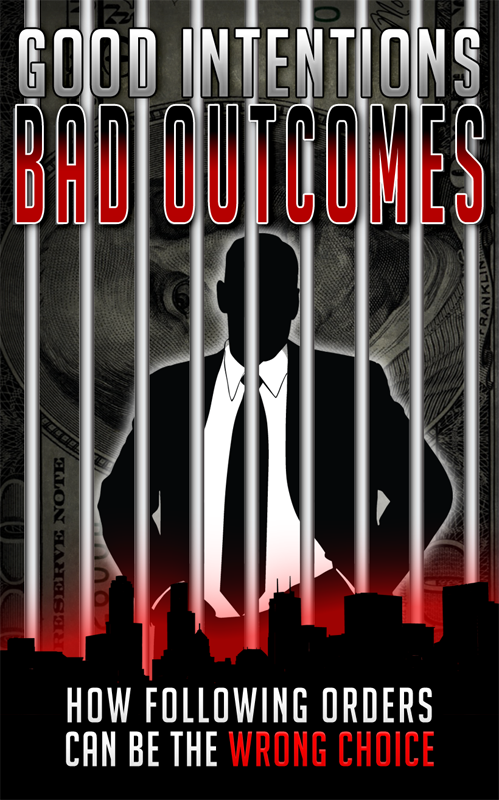

Good Intentions, Bad Outcomes: How Following Orders Can be the Wrong Choice

Prior to the troubles Harold experienced at Lancelot, he thoroughly enjoyed his job and welcomed the change from the public accounting culture. He enjoyed hedge fund work, the people and, most importantly, he respected and trusted his CEO, Gregory Bell.

According to the SEC complaint, Lancelot Investment Management, LLC was a Delaware Limited Liability Company with offices in Northbrook, Illinois and was organized by Bell in 2001. Lancelot managed three hedge funds that were organized as limited partnerships. These hedge funds were Lancelot Investors Fund, LP (“Lancelot I”), Lancelot Investors Fund II, LP (“Lancelot II”) and Lancelot Investors Fund, Ltd. (“Lancelot Limited”) also known collectively, as the “Lancelot Funds.”

Bell served as the General Partner of Lancelot I and Lancelot II and as investment manager of the Lancelot Funds. Ultimately, all funds were managed by Bell, who owned 99% of the holding company that owned Lancelot Management.

Before Lancelot Management, Harold worked for two accounting firms which had performed the yearly Lancelot financial statements audits from 2003 to 2007. Harold was the senior manager/director of these audits during this time period.

Harold was hired by Lancelot in 2007 to serve as Vice President of Finance and Accounting. He was paid an annual salary of approximately $150,000 and was to receive a one-time bonus of $10,000. He worked at Lancelot for 15 months before the company imploded.