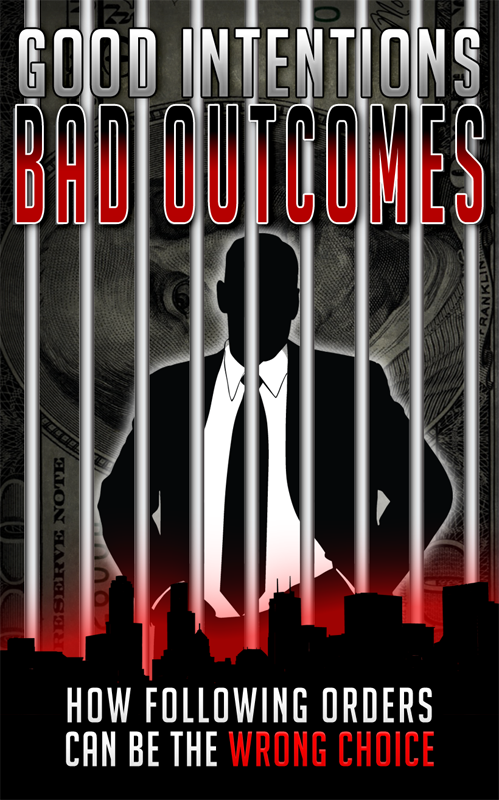

Summary: Exercising professional skepticism is one of the most important responsibilities of an auditor and an accountant. According to AU 230.09, a skeptical auditor is one who “neither assumes that management is dishonest nor assumes unquestioned honesty.” This standard is heavily cited in the authoritative auditing literature; however, these can be difficult assumptions to maintain. This case highlights one accountant’s struggle with exercising professional skepticism while evaluating a client’s financial statements. Additionally, this case discusses how exercising professional skepticism can be important in identifying fraud.

Learning Objectives: After reading the case students will:

- Gain an understanding of the importance of professional skepticism.

- Gain an understanding of audit quality.

- Improve critical thinking skills.

- Gain an understanding of the role accountants/auditors have in fighting fraud.

- Be able to discuss the role of the whistleblower.